What you need to know before buying your first NFT

At the start of 2021, most people hadn’t heard of the word non-fungible token (NFT) and fewer still had any idea of what it meant.

The process of verifying the ownership of both physical and digital assets is an integral component of most businesses and systems. Furthermore, throughout history, individuals have collected scarce and valuable assets such as art, jewelry, and land. Today that trend has extended into collectibles like autographed memorabilia, trading cards, and more. Traditionally, the ownership and authenticity of these assets have been facilitated by paper-based or centralized digital systems, which are often inefficient, present friction in the transfer of assets and leave room for fraud.

In 2017, Dapper Labs launched a decentralized application on the Ethereum blockchain called CryptoKitties, which was the first true example of digitally verifiable and transferable non-fungible tokens. These non-fungible tokens, or NFTs, are collectible game characters with randomly assigned attributes that make each CryptoKitty more or less rare. Using the native digital signature scheme on the blockchain, it is easy to verify the authenticity of each CryptoKitty, its unique attributes, and its owner. Furthermore, the friction and risk of fraud in the transfer of these assets to a new owner is drastically reduced. Today, the foundational invention of non-fungible tokens (NFTs) made popular by CryptoKitties is being applied to a broad set of use cases from digital art and in-game items, to digital identity credentials and land titling.

The concept of fungibility refers to the ability for an asset to be exchanged equivalently with another asset of like kind. A practical example of a fungible asset is the US Dollar, where you can trade one dollar for another knowing the value is exactly the same regardless of which dollar you have. In contrast to fungible assets, non-fungible assets are valued differently based on their unique attributes and scarcity. One such example of this is baseball cards, where each individual baseball card is assigned a unique value depending on its attributes such as edition number, design, player, and rarity. Baseball cards are not fungible because every baseball card is valued differently and thus cannot be exchanged directly for any other baseball card.

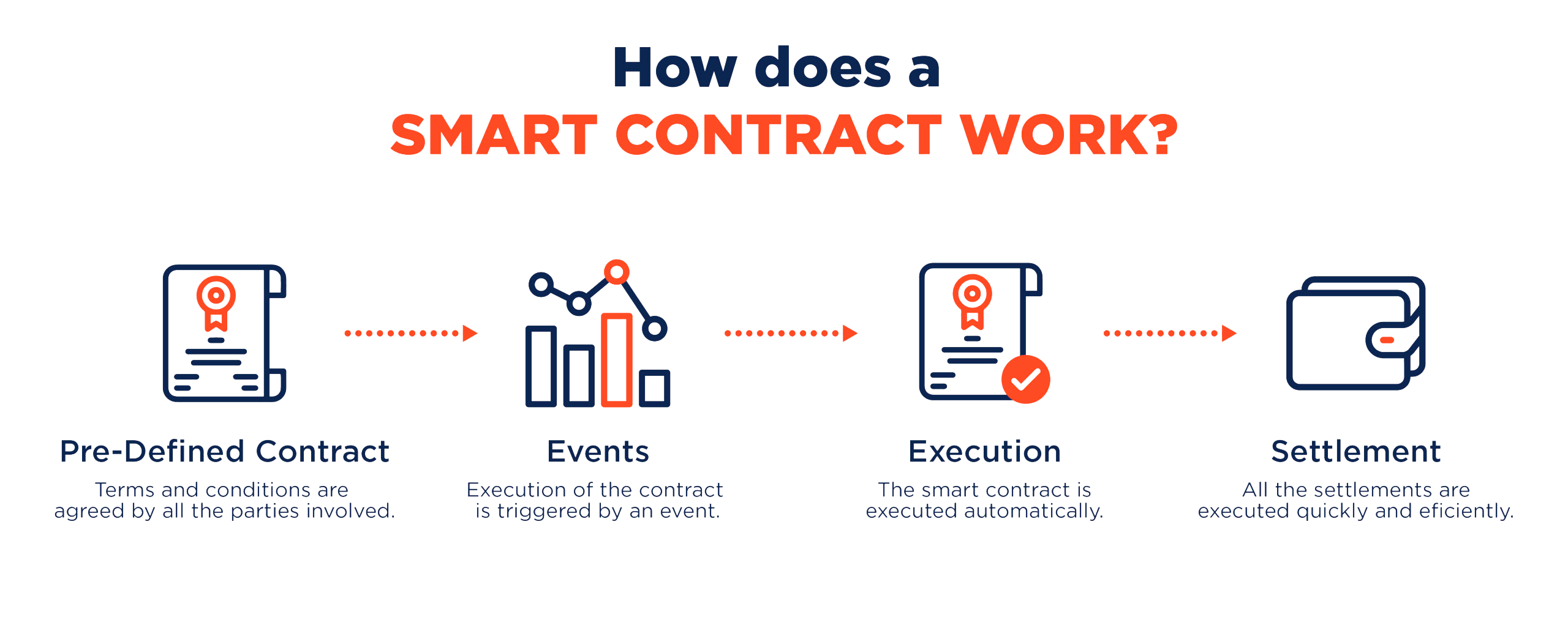

A smart contract is code that is executed deterministically in the context of a blockchain network; each participant in the network verifies the state-changing operations that a smart contract’s code makes. Smart contracts are the primary means by which developers can create and manage tokens on a blockchain. Smart contracts can store small amounts of data in common data structures, which is a critical component of tokenization use cases that map token identifiers to owner identifiers to track who owns which token.

Non-fungible tokens, often referred to as NFTs, are blockchain-based tokens that each represent a unique asset like a piece of art, digital content, or media. An NFT can be thought of as an irrevocable digital certificate of ownership and authenticity for a given asset, whether digital or physical.

Non-fungible tokens (NFTs) are designed to be i) cryptographically verifiable, ii) unique or scarce and iii) easily transferable.

Leveraging cryptographic signatures native to the blockchain on which an NFT is issued, one can easily determine the origin and the current owner of the asset in question in seconds.

A non-fungible token is created by an artist, creator, or license-holder through a process called minting. Minting is a process that involves signing a blockchain transaction that outlines the fundamental token details, which is then broadcasted to the blockchain to trigger a smart contract function which creates the token and assigns it to its owner.

Under the hood, a non-fungible token consists of a unique token identifier, or token ID, which is mapped to an owner identifier and stored inside a smart contract. When the owner of a given token ID wishes to transfer it to another user, it is easy to verify ownership and reassign the token to a new owner.

Non-fungible tokens can be created to represent virtually any asset, whether physical, digital or metaphysical. However, the most common NFT assets are digital art, digital collectible items, pieces of content like video or audio, and event tickets.

NFT event tickets — companies can distribute and sell tickets to events using NFTs, reducing friction for verification of ownership and authenticity and helping to eliminate fraud. Furthermore, there are infinite possibilities for post-purchase collectability of tickets through exclusive experiences and digital art.

Fan/customer engagement – brands or organizations can issue or sell NFTs that represent exclusive collectibles, products, experiences, or voting rights for the future development of a product or service in order to deepen the engagement customers / fans have with the brand/organization.

In-game items – video games are walled gardens today, players do not own their digital items and secondary markets are hard to implement. NFTs can be used to create a widely varied ecosystem of in game digital items that can be bought sold and exchanged on open secondary markets and used across a broader gaming ecosystem rather than anchored to one game.

Digital collectibles – organizations or individuals who have a well-defined brand can create NFTs that can be sold on the open market to fans or brand-loyal customers as collectibles. Think of a company like Disney that has huge brands of licensed universes like Star Wars and Marvel.

Credentialing – identity credentials like driver’s licenses or professional certifications like AWS’ wide range of cloud certificates can be issued as NFTs to reduce the burden of proof for these credentials and eliminate the siloed nature of credentials today.

Royalties – NFTs can track fractional ownership or royalty entitlement for a piece of media or content or art.

There are various challenges and risks that may affect the adoption of non-fungible tokens, including but not limited to:

i) Complexity: The technology and tooling behind non-fungible tokens and the decentralized applications (dapps) that underpin them are still nascent despite the increasing adoption amongst startups and enterprises alike; Many of the complexities associated with building NFT-related solutions are not yet abstracted by quality tooling.

ii) Regulatory/Legal Implications: With the introduction of new and innovative technologies, particularly ones that involve speculative or high-value assets, come distinct regulatory and legal considerations including but not limited to know your customer procedures, anti money laundering mechanisms, and securities law compliance.

iii) Rapid Innovation: The rapid pace of innovation in the NFT ecosystem and the blockchain networks on which they are issued presents challenges for those adopting the technology in the form of consistent change; agility and modularity are critical.

iv) Concerns Regarding Ecological Impact: Controversy continues in regard to the impact that energy-intensive blockchain networks that utilize the Proof-of-Work consensus mechanism have on climate change, and NFT-focused products have been a target for such criticism. However, solutions already exist to ameliorate this concern, such as the adoption of less energy-intensive consensus mechanisms and the use of “Layer 2” or L2 networks where transactions that mint NFTs can be validated more rapidly and efficiently outside of the main blockchain network. For example, the Ethereum blockchain network is well on its way to shifting towards the more energy-efficient Proof-of-Stake consensus mechanism in its Ethereum 2.0 launch, and Layer 2 solutions like Polygon and ImmutableX are already helping reduce the load today.

At the start of 2021, most people hadn’t heard of the word non-fungible token (NFT) and fewer still had any idea of what it meant.

Just as a physical wallet allows you to store your money, a blockchain wallet allows you to manage and use your cryptocurrencies and other blockchain-based

Over the course of history, the face of gaming has evolved at an unprecedented rate. Aided by advancements in technology, the gaming arenas have gone